On December 27, 2023, the Cabinet of Ministers of Ukraine approved the National Income Strategy until 2030 by Resolution No. 1218-r. Its adoption by the end of 2023 was one of the IMF's requirements for Ukraine before the next review of the current financing program. This event and the provisions of the National Strategy did not receive significant public attention, even though the strategy's implementation, particularly the provisions related to tax changes, will affect a substantial part of working Ukrainians.

It is worth noting that the level of awareness among Ukrainians about how taxation is structured in the country and which taxes they pay was very low before the full-scale war. There is no reason to assume that the situation has changed since the full-scale war started. According to a 2020 study conducted by the Kyiv International Institute of Sociology (KIIS) on behalf of the NGO CASE Ukraine, only about 10% of respondents were able to correctly answer the question about the share of income paid by employees in taxes, and only about 20% correctly responded to the question about VAT paid on purchases worth 1,000 UAH. Out of five questions in the study, which also included questions about the free provision of state services, the primary source of budget filling, and the most significant expenditure of taxpayers' funds, only five out of two thousand respondents could answer all questions correctly.

The low level of public awareness about taxes, budget, and payment for state services leads to the fact that citizens' attitudes towards changes in this area are formed not based on the analysis of the changes but on how these changes are positioned and covered by the media, at best – on how experts comment these changes. In the case of the National Income Strategy, at first glance, everything seems very simple - its adoption was one of the IMF's conditions. In a statement made by IMF Managing Director Kristalina Georgieva after the completion of the 2023 Article IV consultations and the second review of the program under the Extended Fund Facility (EFF) for Ukraine on December 12, 2023, "revenue mobilization is a crucial pillar to help meet financing needs and support reconstruction and social spending. Fiscal priorities include launching the National Revenue Strategy, avoiding measures that erode the tax base, and progressing on reforms to further strengthen the frameworks for medium-term budget preparation, budget credibility, fiscal risks and transparency, and public investment management.”

Adopting the National Income Strategy, which also provides for revenue mobilization (i.e., increasing revenue), seems logical and reasonable. However, how exactly does this revenue increase will be achieved? Among the approximately 150 pages of the document covering issues such as administration, tax and customs reform, excise tax increases, and tax on excess profits and property, special attention is paid to the simplified taxation system (STS) reform in 2025-2027. The "reform" involves eliminating the simplified tax system for legal entities and significantly transforming the tax system for individual entrepreneurs (FOPs). The second and third groups of the STS for FOPs will be merged into one group, for which a differentiated rate scale will be created, ranging from 3% (for trading activities) to 17% for certain services. Additionally, usingcash registers become mandatory for taxpayers in this group. Currently, FOPs in the third group of the STS are subject to a tax rate of 5%.

Will these changes increase budget revenue? Mathematically, yes. However, society is a complex mechanism in which economic and social processes are closely intertwined, and assessing the consequences of any decision requires considering all processes. This is why economic sociology focuses on the interaction between the economic and social spheres of society's life and social and economic processes.

If we examine the proposed solutions and their potential consequences through the lens of social processes, the situation no longer seems so clear-cut. Firstly, it is worth paying attention to the elimination of the simplified tax system for legal entities. Even without referring to specialized sources, one can simply open Wikipedia and read that "The simplified tax system was introduced... to stimulate the development of small businesses and reduce the informal activities of enterprises and informal employment." This seems obvious, but abandoning the simplified tax system and equal taxes for all legal entities would imply that small businesses no longer need support, and the issue of informal employment has been almost entirely resolved.

It is important to note that "equality" is not the same as "justice." Is it appropriate to have the same taxation for all economic entities, including small entrepreneurs and huge financial-industrial groups? According to the results of the study "Attitude of Ukrainians towards oligarchs", conducted by Active Group in 2021, almost half (47.1%) of the respondents considered the "dominance of oligarchs in politics and the economy to be the most dangerous for Ukrainian society." Although, since the beginning of the full-scale war, society has faced other risks and challenges, these results show a rather negative attitude towards oligarchs, as their primary capital accumulation stage was relatively recent, not over a hundred years ago, as with the Rockefellers or the DuPonts. In this context, the same tax burden size for small and medium-sized business representatives and conglomerates perceived as oligarchic, such as SCM, the "Privat" group, or EastOne, does not seem like such a self-evident and justified decision.

It is obvious that the significant transformation of the taxation of individual entrepreneurs will de-facto increase the tax burden on them. In general, both the simplified taxation system and the taxation conditions for individual entrepreneurs are often criticized. For example, in the article "Why should individual entrepreneurs pay lower taxes than others? They shouldn't (Opinion)," published in March 2024 on Texty.org.ua, the authors provide a detailed and vivid explanation of how tax calculations are made and compare how much taxes are paid by officially employed workers, individual entrepreneurs on different groups (referring to various groups of the simplified taxation system), and residents of Diia.City. Using straightforward calculations that are understandable even to non-economists (we must credit the authors for the material's pedagogical value), the authors show that officially employed workers pay significantly higher taxes in percentage terms than individual entrepreneurs or Diia.City residents. For example, out of 20,000 UAH earned, an individual entrepreneur of the first group will pay 9.3% in taxes, the second group - 14.9%, the third group - 12.8%, a Diia.City residents - 14.3%, and an officially employed worker - 34% (considering the personal income tax and the tax paid by the employer).

It is clear that the simplified tax system has its drawbacks, the main of which is that large companies use individual entrepreneurs (FOPs) as a tool for tax optimization (essentially tax evasion) - starting from conducting business through FOPs (which is very common in retail trade, HoReCa, etc.) and ending with hidden employment (IT companies are unanimously leading in this regard). And this can indeed be fought if the goal is to maximize tax revenues. However, when a person has a runny nose, cutting off their head is unnecessary.

However, when arguing for the recommendations regarding a "unified approach to taxing individuals' income," which assumes that "payments to the state should be the same regardless of the nature of income," the authors of the above-mentioned article on Texty.org.ua again proceed from the thesis that "equal taxes on income for everyone is a prerequisite for a healthy business climate and a basic element of fairness." And here again, it is necessary to return to the differentiation of the concepts of "equality" (or sameness) and "fairness." Equality is essentially a mathematical concept that does not allow for interpretive variability. At the same time, fairness encompasses objective relationships and their subjective evaluation according to a particular criterion (Libanova et al., p. 22). Unfortunately, in the perception of broad population segments, social justice is most often associated with social equality. However, the presence of objective relationships and related subjective assessments leads to the possibility of different concepts of justice. Only as the prominent or most well-known concepts of justice or fair income distribution can four be noted: egalitarian, utilitarian, Rawlsian, and market. The egalitarian concept assumes that all members of society receive equal benefits, the Rawlsian (associated with the name of the modern American philosopher John Rawls) - that the utility of the least well-off members of society is maximized, the utilitarian - that the overall utility of all members of society is maximized, and the market - that the market and its regulators establish social justice.

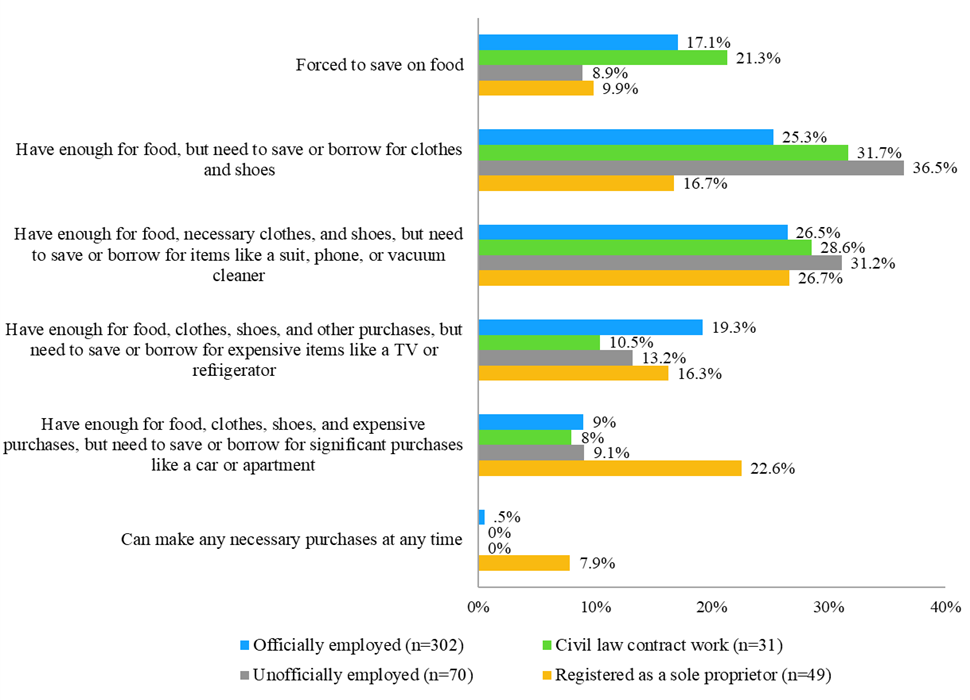

However, let's return to the practical aspects of equality and fairness. In the monthly national Omnibus survey conducted by Info Sapiens on September 19-25, 2023 (N = 1000, data collection method - CATI), a block of questions was included regarding the employment of respondents, which included a question about how the respondent's relations with the employer are formalized on the main job. The answer options included such alternatives as "Officially employed (on) (in staff, with a workbook (employment history))," "Work under a civil law contract (not in staff, without a workbook)," "Unofficially employed (without concluding any contracts and without a workbook)," "Registered as an FOP (individual entrepreneur)," "Other." Cross-tabulating this question with the question about the financial situation of the family allows us to conclude that among the respondents who are registered as FOPs, there is a higher percentage of people with a high material status - who can afford expensive purchases or any purchases at all.

We cannot disregard the fact that, unlike hired employees, individual entrepreneurs take risks and bear responsibility for their own property and funds, which should involve a certain "risk premium" (which is reflected in the graph), although this thesis is debatable. However, the data presented confirm that in the case of individual entrepreneurs, it is possible to increase the tax burden - a mathematically logical conclusion. However, real life is more complex with its long-term effects, and forecasts cannot be based on the assumption of "all other things being equal." In this particular case, it would be appropriate to consider such aspects as mobility.

According to the United Nations High Commissioner for Refugees (UNHCR), as of February 2024, there were about six million Ukrainian refugees in Europe, and the total number of refugees reached six and a half million (not including those Ukrainians who left for Russia and Belarus, because there are no correct statistics for them). Among them, there were 952,000 Ukrainians in Poland as of February 2024.

According to "Rzeczpospolita", based on official statistics, in 2023, every tenth FOP registered in Poland was registered by Ukrainians. In Poland, there are three types of taxation available for FOPs (JDG - jednoosobowa działalność gospodarcza): ogólne zasady - the general taxation system, podatek liniowy (so-called flat tax) - the linear system, and ryczałt (so-called lump tax) - the simplified taxation system. The level of taxes for individual entrepreneurs in Poland is higher than in Ukraine. And even with this, Ukrainians are starting to open more and more businesses in Poland. However, implementing the "National Income Strategy until 2023" may make the tax burden in Ukraine for FOPs very similar to the Polish one. And what can Ukraine offer besides increased taxes? Protection against the arbitrary actions of state security and law enforcement and corruption at all levels? Transparent and fair justice? High social standards? And is the effect of a short-term increase in tax revenues worth the subsequent loss of not only the most economically active population but also the population that can take responsibility and risks in the economic sphere? Undoubtedly, at the micro-level, each citizen of Ukraine, whether an employee, an individual entrepreneur, or the owner/manager of a small or medium-sized business, will make a personal decision whether to stay in the country or not. However, for the further development and rebuilding of Ukraine, it is crucial that when making state decisions that will shape the country's image in the future, possible social consequences of such decisions are considered.